“There is good reason to look at

the economic data and say that the workforce situation continues to improve,”

says Rob Romaine, president of MRINetwork. “People continue to see friends and neighbors

going to work and nothing will rebuild sentiment faster than that. Consumer

debt, which is increasing after years of consecutive quarterly declines shows

that people have more confidence in their jobs and in their economic

future."

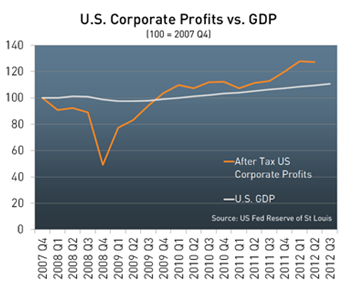

Adding weight to the deluge of

economic figures, GDP grew at an annualized rate of 2 percent from 1.3 percent

in the second quarter of the year. The figure was more positive than many

economists projected, yet it still is unlikely enough to pull growth in 2012 as

a whole over 2 percent. Such growth, though, is not typically enough to drive

substantial improvements in employment markets, and certainly not enough to

push unemployment down half a percent in two months. Yet, that isn’t

necessarily cause to think that either the employment or GDP figures are incorrect.

Since about 2008, the number of

employees voluntarily leaving their jobs fell significantly as people didn’t

want to, or couldn’t change jobs at the rate they once did. The U.S. quit rate

fell as low as 1.2 percent in late 2009, but has since recovered to 1.6

percent. The rate among workers who feel overworked or under-compensated is

understandably even higher.

“Even if a company isn’t cutting

its staffing levels, it likely is losing employees to churn at a higher rate

today than they were two years ago,” says Romaine. “While through the recession

managers might have tried to cover those losses with existing staff, today

companies have reached a point where most positions vacated need to be

backfilled. If a salary lasted in the budget through the recession, it was a

position worth keeping filled.”

If hiring is increasing, however,

that could very well help add buying power to the economy just in time for the

holiday season, giving a possible boost to fourth quarter GDP.

The United Kingdom recently

experienced a similar situation where employment was growing while GDP was

shrinking. The counter cyclical employment growth was puzzling to many

economists giving it names like 'the employment paradox' and the 'economic

puzzle.' Whatever the cause though, the increased employment likely helped to

lift the UK economy out of recession in the third quarter.

So whether the dog wags the tail,

or the tail wags the dog, 2013 seems to be building the potential for some

upside surprise for both the economy and labor market.